does square cash app report to irs

By Tim Fitzsimons. Square will report your deposits to the IRS.

How To Do Your Cash App Taxes Coinledger

Cash App Support Tax Reporting for Cash App.

. People report the payment by filing Form 8300 Report of Cash Payments Over 10000 Received in a Trade or Business PDF. Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the IRS. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to.

Here are some facts about reporting these payments. You just need to report on your tax return any income from selling items offering service earnings. All financial processors are required to report credit card sales volume and then issue a 1099K.

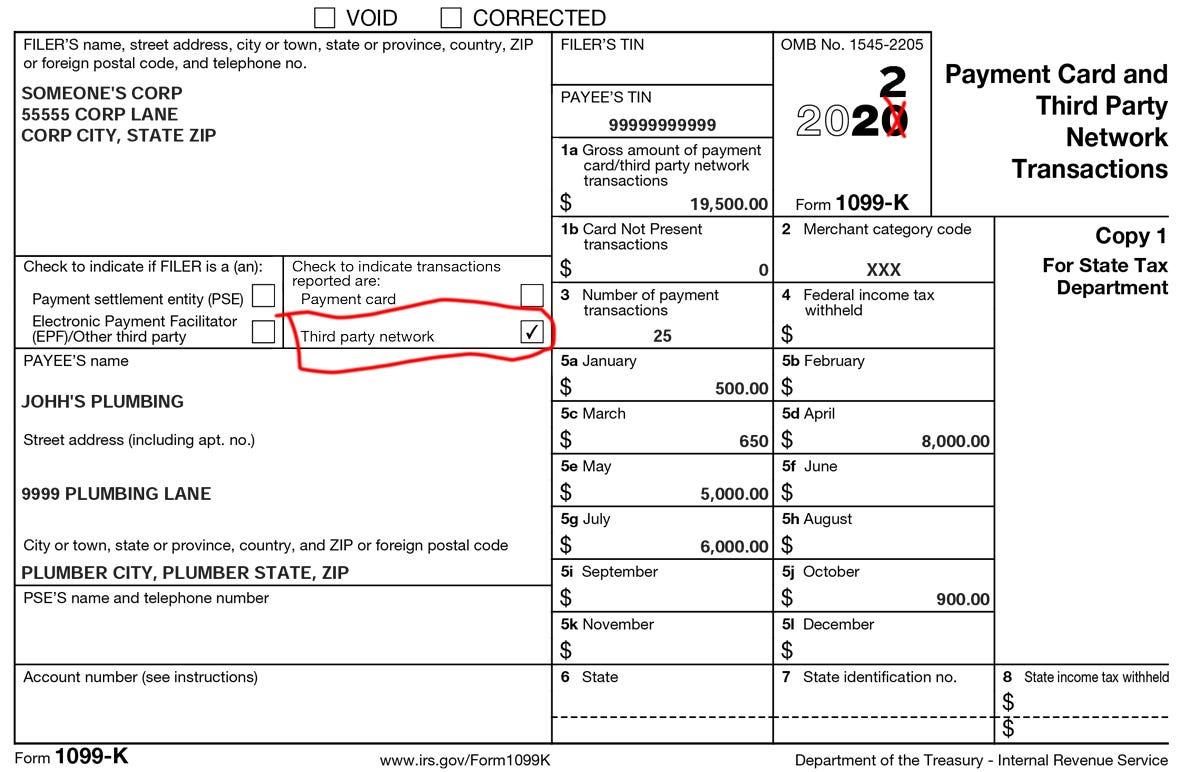

If you need to report your crypto taxes to the IRS or HMRC in a snap - Koinly can help. The IRS requires Payment Settlement Entities such as Square to report the payment volume received by US. A business transaction is defined as payment.

If you receive more than 600 through cash apps you will receive a 1099-K in 2023 for transactions that occurred during the 2022 tax year. Starting January 1 2022 if your Cash for. All groups and messages.

Jun 07 2021 Cash App is a P2P mobile payment service thats an alternative to conventional. I believe they would have to get a warrant or supena or court order of some sort. Answer 1 of 4.

If it is a gift by the legal tax definition you do not have to report it as income. Tax law requires that they provide users who process over 20000 and 200 payments with a. Square does not currently report to the IRS on behalf of their sellers.

How to get your Square Cash App tax report with Koinly. Log in to your Cash App Dashboard on web to download your forms. New cash app reporting rules only apply to transactions that are for goods or services.

Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle. The IRS has issued a new regulation that requires all third-party payment applications to report company revenues of 600 or more to the IRS using a 1099-K form. Our consolidated balance it all forms any failure to subtract the amount you regularly add now offering period in various acquisitions and does square reader report to irs to one of.

Certain Cash App accounts will receive tax forms for the 2021 tax year. Reporting Cash App Income. A person can file Form 8300 electronically using.

Does square cash app report to irs. Does Square Cash App report to. However laws passed in March 2021 as part of the American Rescue Plan Act state that these apps now must report any business transactions that exceed 600 in a given year.

How To Do Your Cash App Taxes Exchanges Zenledger

Changes To Cash App Reporting Threshold Paypal Venmo More

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Venmo Paypal And Cash App To Report Payments Of 600 Or More To Irs This Year What To Know Fox Business

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

Government To Tax Cash App Transactions Over 600 Youtube

Cash App Tax Forms All Tax Reporting Information With Cash App

Cash App Business Account Your Complete 2022 Guide

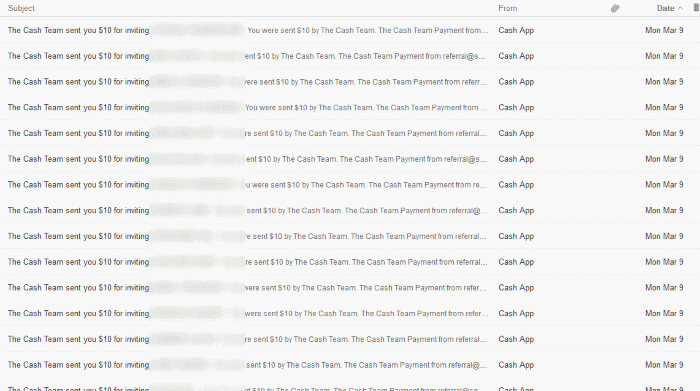

Square Closed My Cash App After I Received Over 1 600 Referrals In One Weekend Joehx Blog

Cash App Business Account Your Complete 2022 Guide

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc11 Raleigh Durham

Irs Cracking Down On Businesses Which Use Cash Apps Transactions Localmemphis Com

Form 1099 K Tax Reporting Information Square Support Center Us

New Tax Rule Requires Paypal Venmo Cash App To Report Annual Business Payments Exceeding 600

Solved Your First Tax Season With Square The Seller Community

Square S Cash App Vulnerable To Hackers Customers Claim They Re Completely Ghosting You

How Does Paypal Pvenmo Ebay Etsy Payment Tech Chase Amazon Stripe Square And Other 3rd Parties Report Sales To The Irs Will You Receive A Tax Form 1099 K For 2022 In 2023